Barclays Bank Account

Flexible, rewarding banking

Apply for a bank account and use our app1 to help keep your money under control.

Benefits you’ll get

Money management tools

Stay in control of your finances with the Barclays app1 – get spending insights, flexible security controls and more.

Optional arranged overdrafts

Set up an arranged overdraft to suit your needs.

Eligibility

To apply for a Barclays Bank Account, you’ll need to be

To get a joint account, you’ll both need to meet the above criteria.

Not eligible for this account? Explore our other options.

Open and manage your account with the Barclays app

-

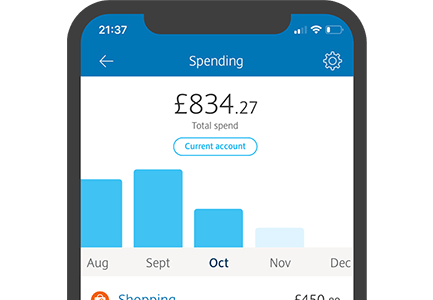

Spending insights

- See a summary of your spending by category, shop or business

- Track where and when you’ve made payments

- Set daily spending limits

-

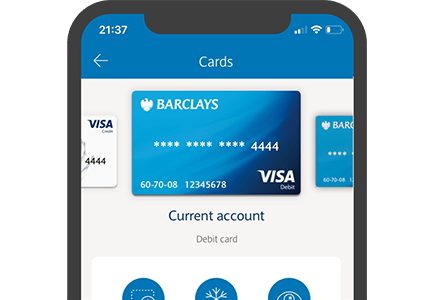

Flexible security controls

- Temporarily freeze your debit card if you can’t find it

- Get a PIN reminder whenever you need it

- Report your card lost or stolen

-

Get your account with the Barclays app

- Download the app

- Upload a video selfie and add photo ID to verify your identity

- Get instant access to your new current account

Before you apply, take a look at the important information about overdrafts

-

An overdraft limit is a borrowing facility which allows you to borrow money through your current account.

There are two types of overdraft – arranged and unarranged.

An arranged overdraft is a pre-agreed limit, which lets you spend more money than you have in your current account. It can be a safety net to cover short-term outgoings, like an unexpected bill. It is not suitable for longer-term borrowing. We charge you for every day of the month that you use your arranged overdraft where you go beyond any fee-free limit you may have.

An unarranged overdraft is when you spend more money than you have in your current account and you have not agreed an arranged overdraft limit with us in advance or you have exceeded an existing arranged borrowing facility.

You can only make payments from your account if you have enough money in your account or through an arranged overdraft to cover them. Barclays will always attempt to return any transaction that could take your account into an unarranged overdraft position. Having enough money in your current account or having an arranged overdraft limit could help prevent payments such as priority bills from being returned unpaid.

On very rare occasions we may be unable to return a payment (e.g. due to an offline transaction made on a flight) and the account may enter an unarranged overdraft. No additional charges will be applied in this situation.

Information regarding the conduct of your account may be sent to credit reference agencies. As with any debt or borrowing, this may affect your ability to get credit in the future.

Our Eligibility tool can show you the likelihood of getting an arranged overdraft and the overdraft calculator lets you see how much it could cost to use an overdraft. To use these tools and find out more about overdraft charges, please visit barclays.co.uk/youroverdraft.

If we hold a valid mobile number for you, we’ll automatically enrol you to receive relevant alerts regarding borrowing and refused payments, to help you avoid charges. You can also choose to receive additional alerts, including Low Balance and Large Credit or Debit. Tailor your alerts to your personal needs online, by phone or in branch. To find out more, visit barclays.co.uk/alerts.

How to apply

Sole account

Get a Barclays Bank Account for one person

To apply for this account in the app2, you’ll need to:

- Be 18 or over

- Have a UK mobile number

- Provide proof of identity, like a passport or driving licence.

If you don’t have a UK mobile number, you can apply online instead.

Joint account

Get a Barclays Bank Account between two people

To apply for this account, both account holders will need to:

- Be 18 or over

- Have lived in the UK for at least 12 months.

The other account holder will need to be with you during the application.

For more information on what you could get with a joint account, take a look at our joint account features

Already have a current or savings account with us?

Save time and apply with your existing details

You can log in and apply for a new current account in our app or Online Banking.

Applying in the Barclays app

If you already have the app

Go to ‘Products’, then ‘Current accounts’ to apply.

Frequently asked questions

-

Yes, we offer arranged overdrafts with our current accounts. An arranged overdraft is a borrowing facility that allows you to borrow money through your current account. All overdrafts are subject to application, financial circumstances and borrowing history.

-

Applying for a Barclays Bank Account on the app should take around 10 to 15 minutes to complete. If your application is approved, then you will get your account details right away and can start using the account immediately. Your Barclays debit card will be sent separately to your PIN and will arrive within five working days.

-

Yes, anyone with a UK biometric residents permit is eligible to open a Barclays Bank Account through the Barclays app.

-

You can cancel your application any time up to 14 days after either opening it or receiving your account terms and conditions – whichever is later.

-

Applications for a Barclays Bank Account are completed through the Barclays app. If you’re not able to use the app due to accessibility issues or another reason, you can call to book an appointment. Our team will be happy to assist with your application – you’ll need proof of ID and your UK address.

Lines are open Monday to Sunday, 8am to 9pm

Call 0345 600 4545

We accept the following as proof of ID

- UK/EU/EEA photo card driver’s licence

- UK biometric residence permit

- Passport

We accept the following as proof of address

- UK utility bill (from last 3 months)

- Council tax bill (from last 12 months)

- Bank account statement (from last 3 months)

- Credit card statement (from last 3 months)

- UK credit union statement (from last 3 months)

- Mortgage statement (from last 12 months)

- Benefit entitlement letter (from last 12 months)

- HMRC letter (from last 12 months)

- Tenancy agreement (from last 12 months from local council or housing association

- Council tax exemption certificate issued within the past 12 months, for the current tax year

- Foreign bank statement dated within the last 3 months that shows your UK address

- Foreign credit card statement dated within the last 3 months that shows your UK address

- HM forces family offices letter dated within the last 12 months

- UKVI trusted sponsor letter from your employer, dated within the last 3 months. It must confirm you have a fixed-term contract for at least one year.

- Royal Mail postal redirection notification to your current address, dated within the last 3 months

- Residential nursing home letter dated within the last 3 months

- Universal Credit statement dated within the last 12 months

-

Yes, you can switch your current account to us. It takes just seven working days, and the full switch option is backed by the Current Account Switch Guarantee [PDF, 37.3KB].

Terms and conditions

Please read these important guides to your rights and responsibilities when using the Barclays Bank Account

-

-

Tariff of charges for personal accounts [PDF, 1.4MB]

-

Fee Information Document - Barclays Bank Account [PDF, 394KB]